When you travel to another country with a different currency, there’s always the existential question: do you exchange currency on the spot, or can you pay by card and get away with it?

Well, that’s the question you have to ask yourself when you come to Mauritius. The currency is the Mauritian Rupee (MUR).

Although Euros and Dollars are accepted in some tourist resorts and hotels, this won’t be the case in the little store on the beach or with a strolling fruit vendor.

Personally, even if I left France, I haven’t closed my bank accounts.

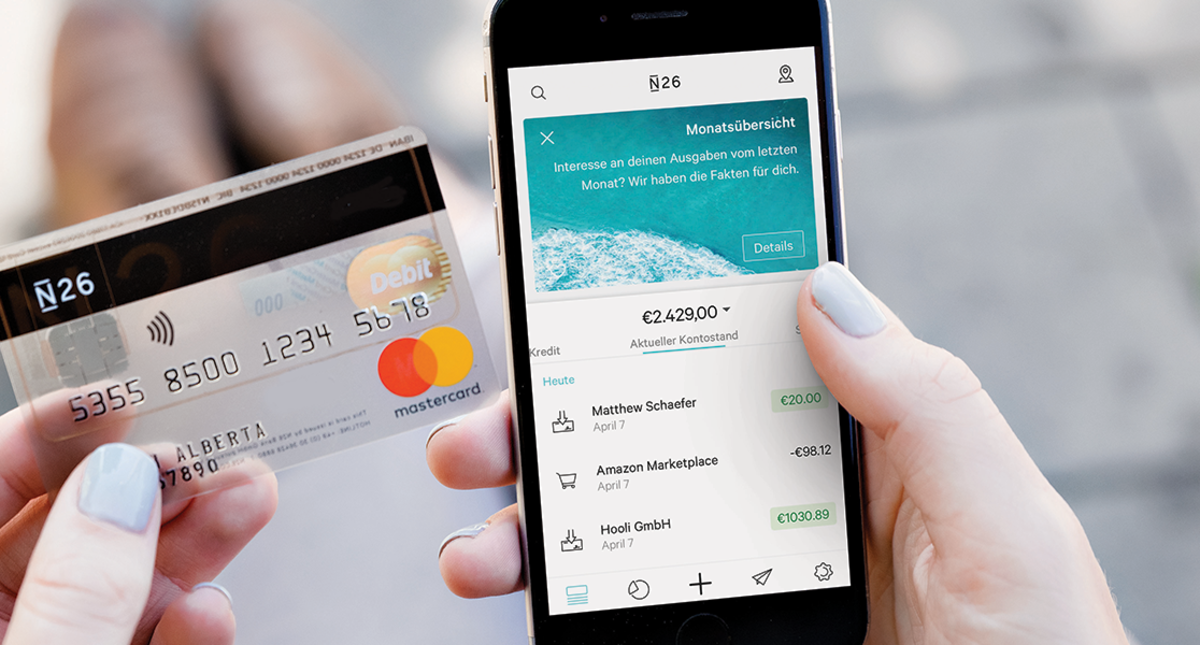

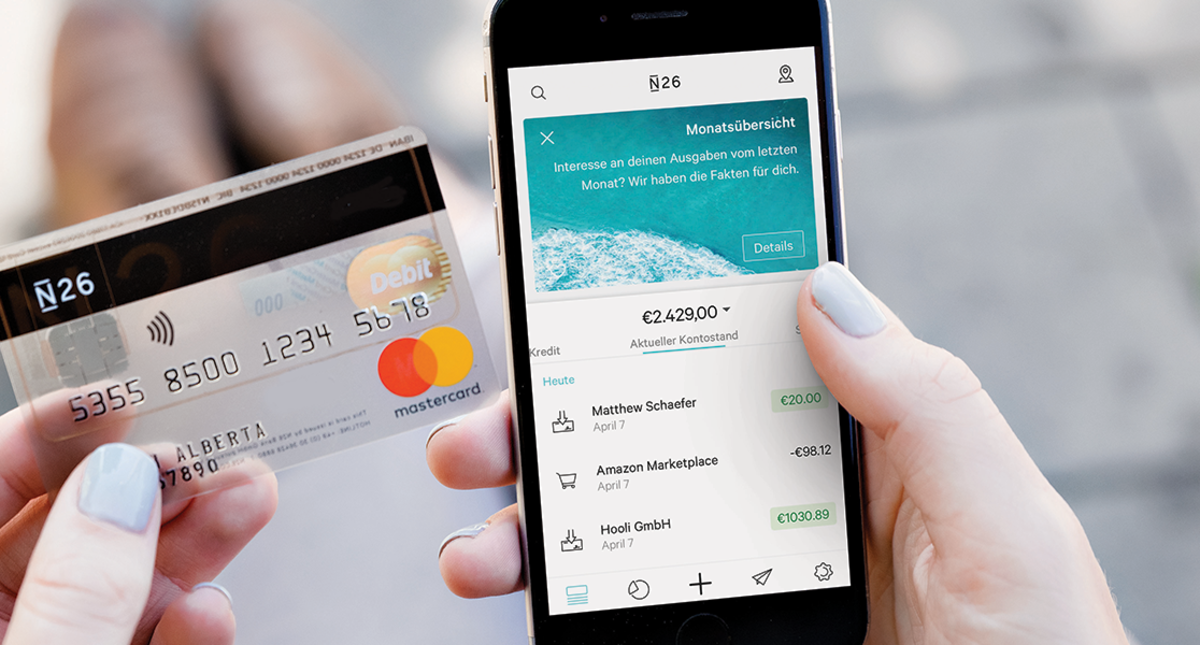

In fact, I’ve kept my N26 account, a German neo-bank with which I’m very satisfied. You should know that I use their bank card even here on this little island. I’ll share my good plan with you.

Table of Contents

The benefits of N26 abroad

With N26, there are ZERO commission fees for card payments.

“At N26, no fees are charged when paying by card in foreign currencies and you benefit from the Mastercard real exchange rate without any markup, even on weekends.”

So I pay in foreign currency rather than euros?

Choose the foreign currency for N26, the Mastercard real exchange rate will apply and you won’t be charged any commission on the payment.

What about withdrawals?

If you opt for an N26 You or N26 Metal account, withdrawals in foreign currencies are free of charge and unlimited.

If you opt for a standard N26 account, a commission of 1.7% of the total amount is charged for each foreign currency withdrawal. This fee is charged within a few days.

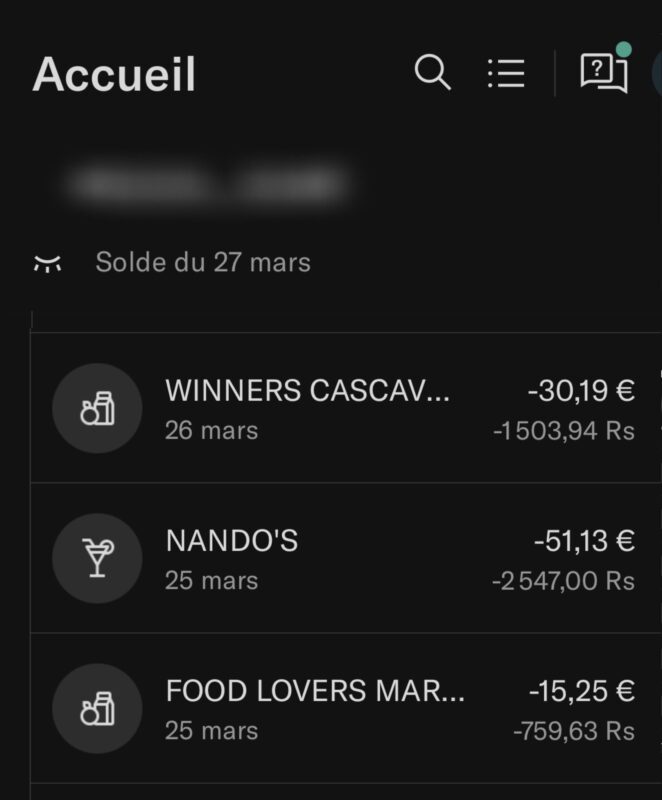

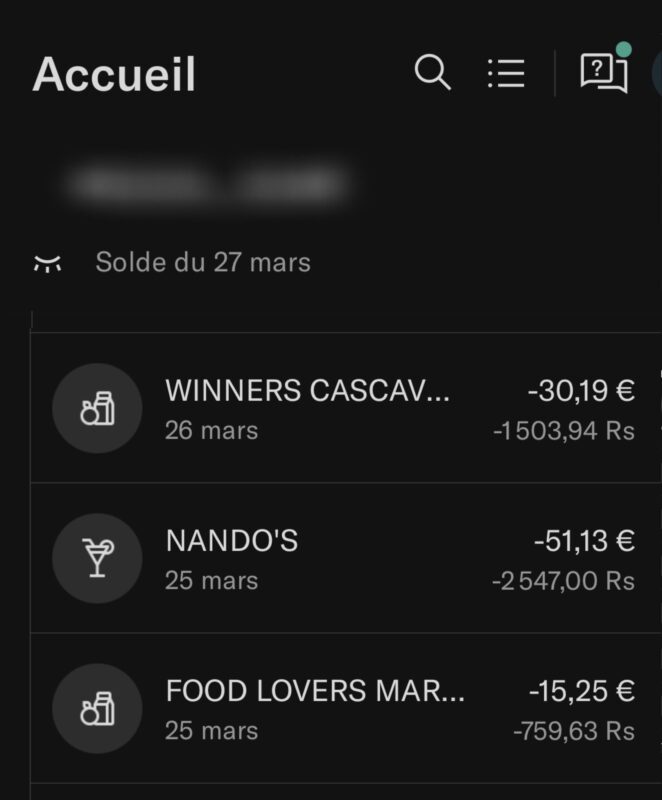

On a daily basis, I pay with my N26 card and make my withdrawals with my MCB card.

The advantages +

I see the transaction instantly on my app as soon as a payment is made. You’ll see the amount in euros and foreign currency!

4 types of bank account available

- N26 standard FREE but with limited options (this is my account)

- N26 Smart at EUR 4.90 per month with budget management tools

- N26 You at EUR 9.90 per month for travel and everyday needs

- N26 metal at EUR 16.90 per month, the Premium package with a host of advantages

Account opening in 8 minutes and super-clear, easy-to-use application.

Referral code

→ Get 20 EUR free when you open your account with my referral link: https://n26.com/r/juliep8883

Please note that opening a N26 account is not yet available from Mauritius. Therefore, you will need to open your account from France, before your departure. Or else have a postal address in France where you can receive your bank card.

Of course, there are always other banks, but be sure to check the terms and conditions for payments and withdrawals abroad (outside the EU zone) to avoid any unpleasant surprises. By way of comparison, with my Boursorama Visa Premier, I pay 1.69% commission for each card withdrawal and payment.

And if you want to exchange currency on the spot, I recommend Shibani Finance. They are present at the airport for instance.

I hope you find this article useful.